Nifty and Bank-Nifty Prediction for Tomorrow, Aug 24

check SEBI new step - LINKNifty Forms Distribution Day, Bears in Control

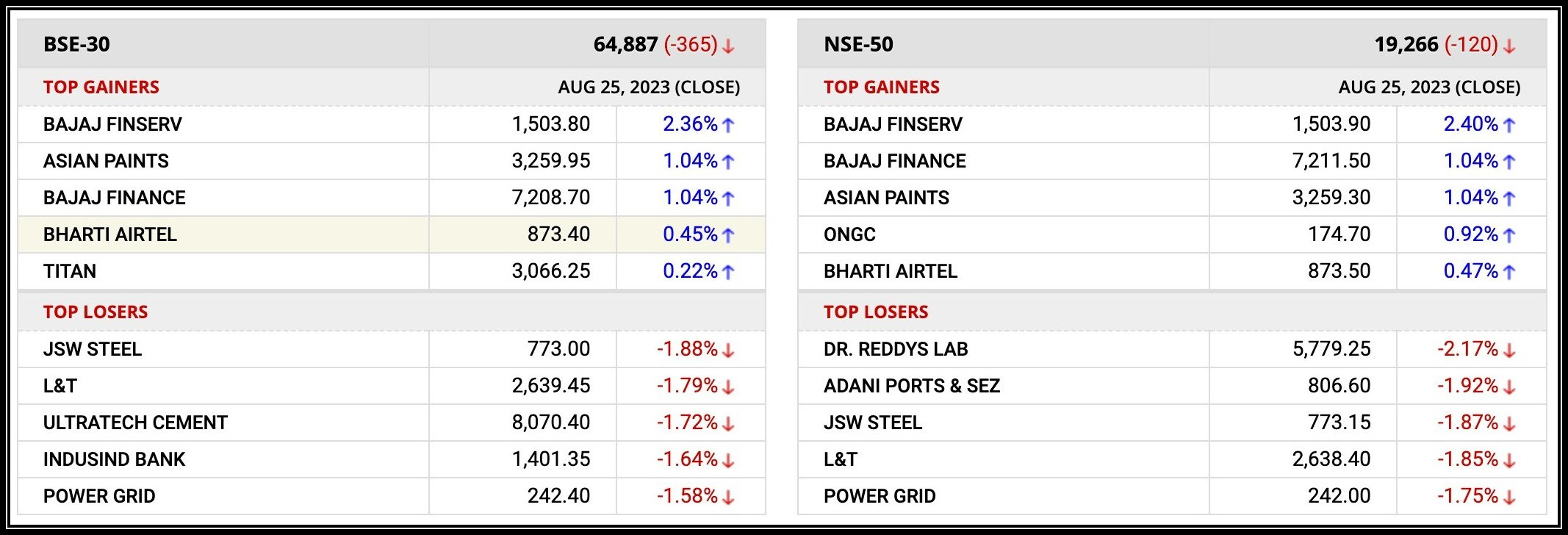

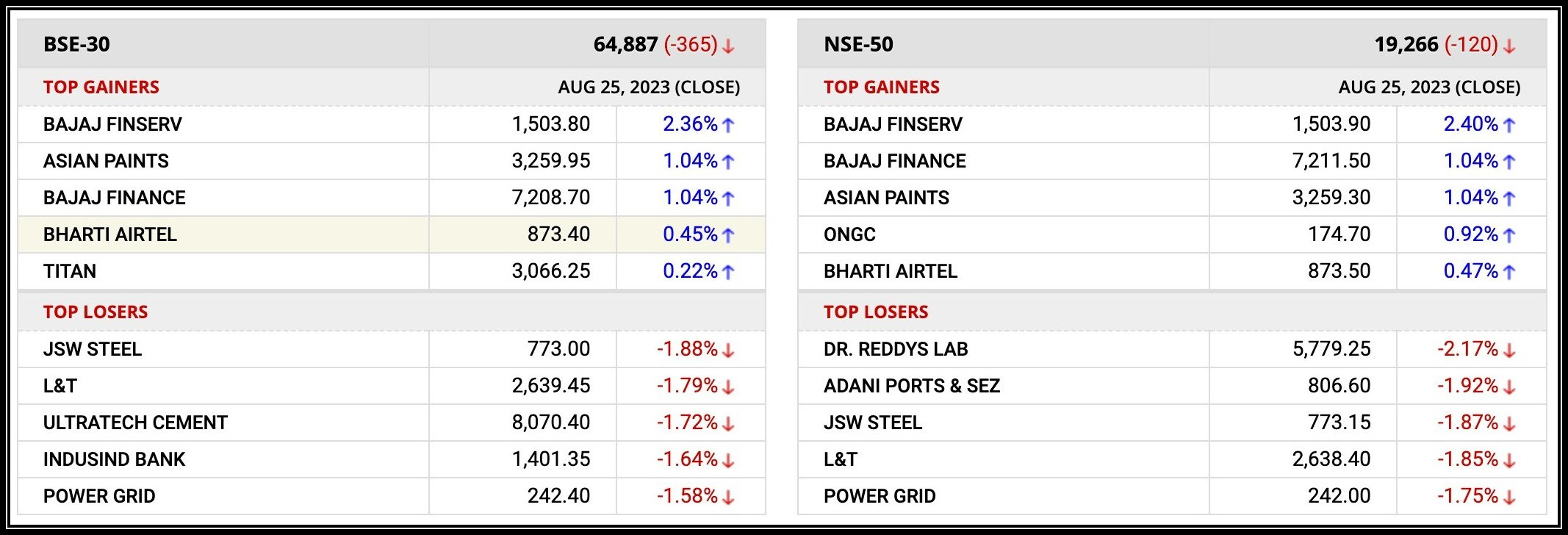

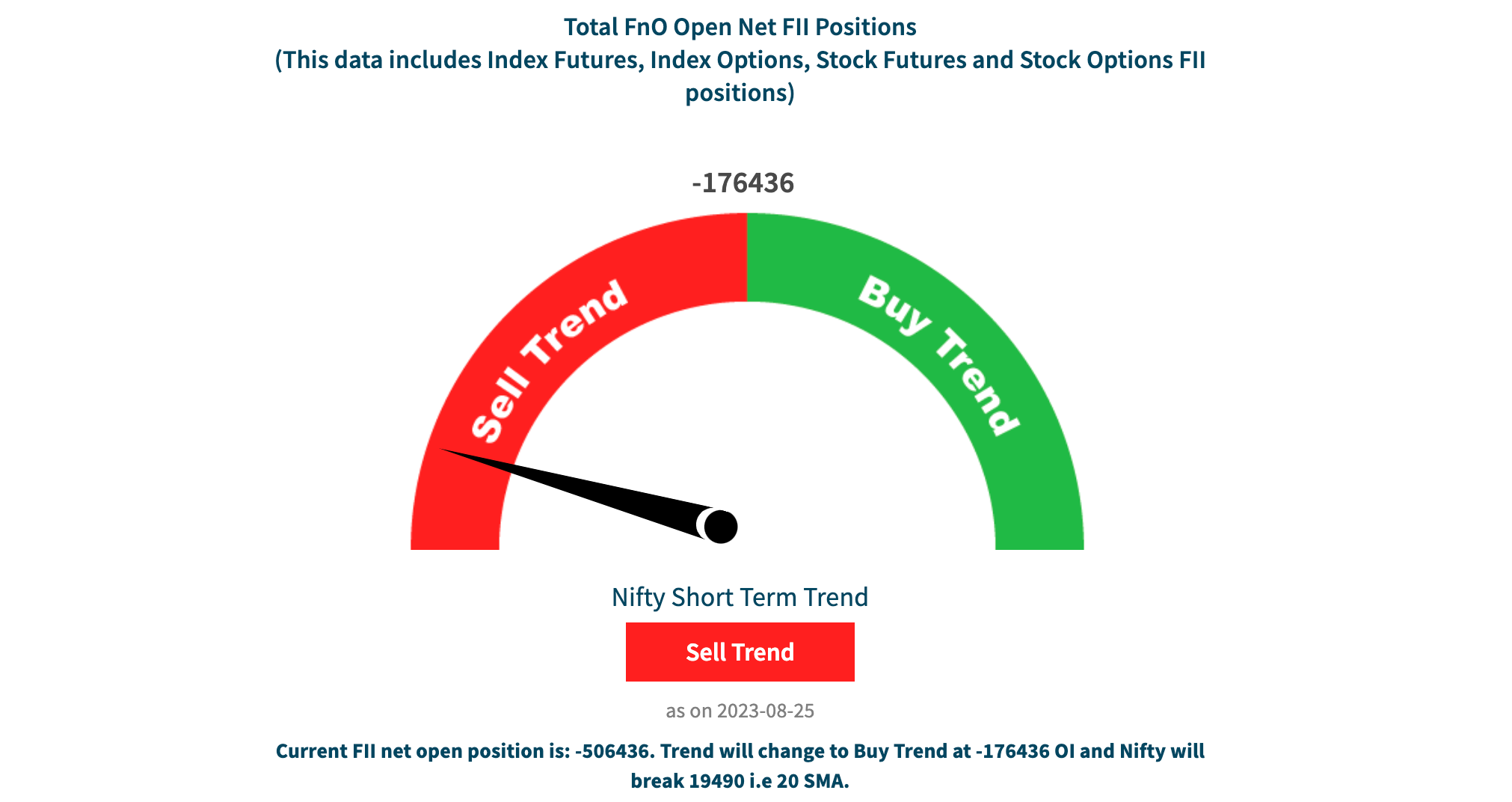

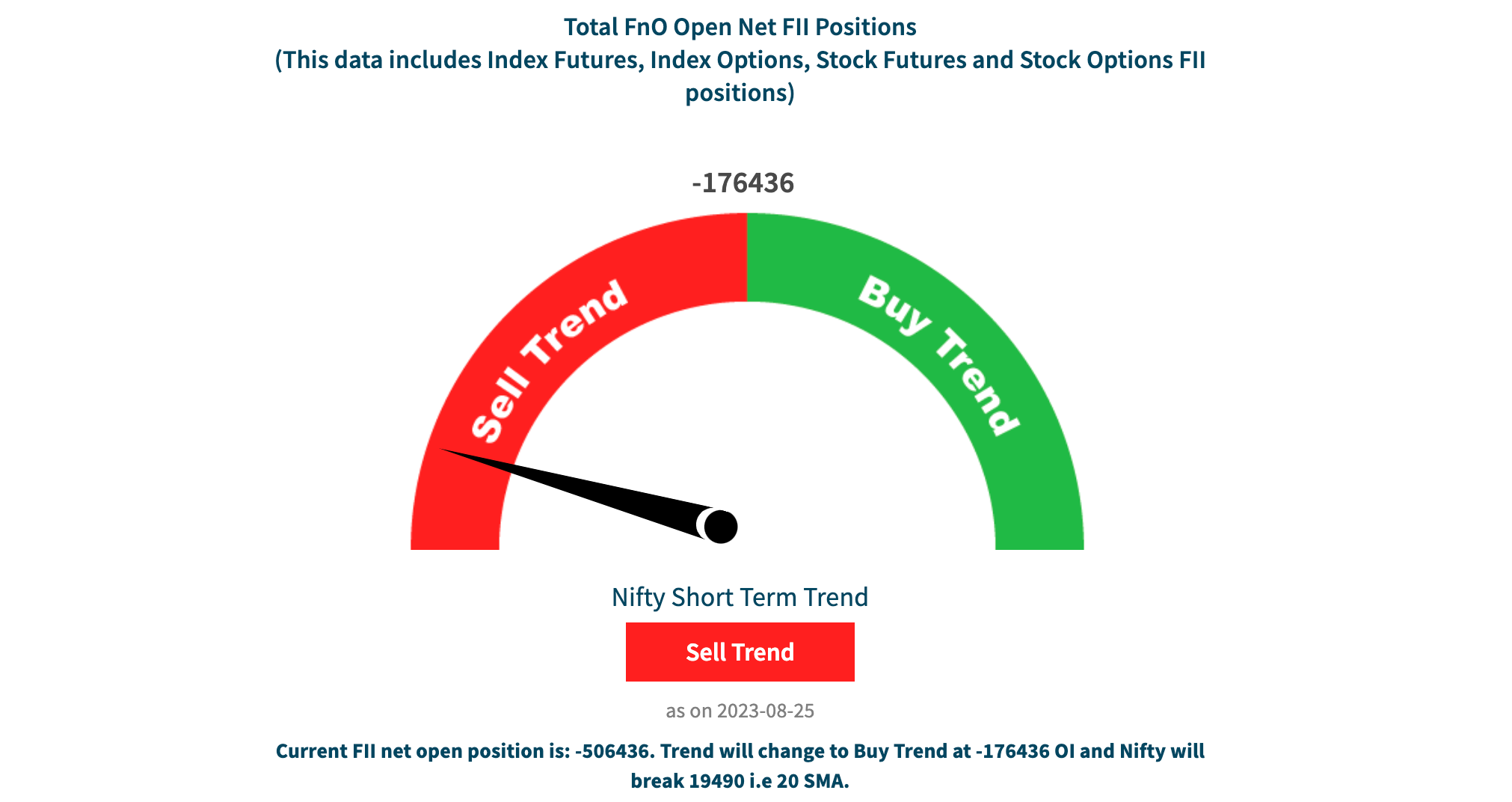

The Nifty index formed a distribution day on Wednesday, signaling that bears are in control and could continue to pressure the index in the near term.

The index gapped lower and breached its 50-day moving average (DMA), falling more than 20 basis points (bps) on volume higher than the previous day’s session. This indicates that there are more sellers than buyers in the market.

The multiple block deals that were executed on Wednesday also point to selling pressure from institutional investors. Block deals are large trades that are executed over the counter, outside of the open market. They often signal a change in sentiment among institutional investors.

The overall technical picture for the Nifty index is bearish. The index is trading below its key moving averages and has formed a distribution day pattern. This suggests that the index could continue to decline in the near term.

Here are some additional things to know about the Nifty index:

- The Nifty Index is a stock market index of the 50 largest and most liquid stocks listed on the National Stock Exchange of India.

- The index is calculated using a free-float market capitalization methodology.

- The Nifty index is a benchmark for the Indian stock market and is widely followed by investors and traders.

Conclusion:

The Nifty index is in a bearish trend and could continue to decline in the near term. Investors should remain cautious and avoid taking any long positions until the index shows signs of strength.

🔗 Join our Telegram Channel! 🔗

📲 Click on the link below to join:

🚀 Stay updated with the latest market trends and insights. 📈📊

- What are the key factors that led to the formation of the distribution day pattern?

The key factors that led to the formation of the distribution day pattern include:

The index gapped lower on Wednesday, indicating that there was more selling pressure than buying pressure in the market.

The index also breached its 50-day moving average, which is a key technical indicator.

The volume of trading on Wednesday was higher than the previous day’s session, which also indicates that there was more selling pressure than buying pressure.

What are the implications of the distribution day pattern for the Nifty index in the near term?

The distribution day pattern is a bearish signal and suggests that the Nifty index could continue to decline in the near term. However, it is important to note that the stock market is cyclical and that there will always be ups and downs. Investors should not panic sell if the market declines and should instead focus on the long-term fundamentals of their investments.

- What are some of the other factors that could influence the direction of the Nifty index in the near term?

Some of the other factors that could influence the direction of the Nifty index in the near term include:

The outcome of the war in Ukraine

The pace of inflation

The direction of the US dollar

The performance of the global economy

The actions of central banks

- What should investors do in the near term?

Investors should remain cautious and avoid taking any long positions until the Nifty index shows signs of strength. They should also focus on the long-term fundamentals of their investments and not panic sell if the market declines.

In Hindi –

निफ्टी ने डिस्ट्रीब्यूशन डे बनाया, भालू नियंत्रण में हैं

बुधवार को निफ्टी इंडेक्स ने डिस्ट्रीब्यूशन डे बनाया, जो संकेत देता है कि भालू नियंत्रण में हैं और निकट भविष्य में इंडेक्स पर दबाव बना सकते हैं।

इंडेक्स ने एक दिन पहले के मुकाबले कम खुला और अपने 50-दिवसीय मूविंग एवरेज (एमए) को तोड़ दिया, जो पिछले दिन के सत्र की तुलना में अधिक मात्रा में था। यह इंगित करता है कि बाजार में खरीदारों की तुलना में अधिक विक्रेता हैं।

बुधवार को किए गए कई ब्लॉक डील भी संस्थागत निवेशकों से बिकवाली दबाव की ओर इशारा करते हैं। ब्लॉक डील बड़े सौदे हैं जो ओवर-द-काउंटर किए जाते हैं, यानी खुले बाजार में नहीं। वे अक्सर संस्थागत निवेशकों के बीच बदलते रुख का संकेत देते हैं।

निफ्टी इंडेक्स का तकनीकी चित्र मंदी वाला है। इंडेक्स अपने प्रमुख मूविंग एवरेज से नीचे कारोबार कर रहा है और डिस्ट्रीब्यूशन डे पैटर्न बना रहा है। यह इंगित करता है कि निकट भविष्य में इंडेक्स में गिरावट जारी रह सकती है।

निफ्टी इंडेक्स के बारे में कुछ और जानने योग्य बातें:

- निफ्टी इंडेक्स भारत के राष्ट्रीय स्टॉक एक्सचेंज में सूचीबद्ध 50 सबसे बड़े और सबसे तरल शेयरों का एक स्टॉक मार्केट इंडेक्स है।

- इंडेक्स को फ्री-फ़्लोट मार्केट कैपिटलाइज़ेशन मेथडॉलोजी का उपयोग करके गणना किया जाता है।

- निफ्टी इंडेक्स भारतीय स्टॉक मार्केट का एक बेंचमार्क है और निवेशकों और व्यापारियों द्वारा व्यापक रूप से अनुसरण किया जाता है।

निष्कर्ष:

निफ्टी इंडेक्स मंदी के दौर में है और निकट भविष्य में गिरावट जारी रह सकती है। निवेशकों को सतर्क रहना चाहिए और तब तक कोई लंबा पोजीशन नहीं लेना चाहिए जब तक कि इंडेक्स में मजबूती के संकेत न मिलें।