Nifty & Bank-Nifty Prediction for Tomorrow, Dec 04, 2023

Market Update

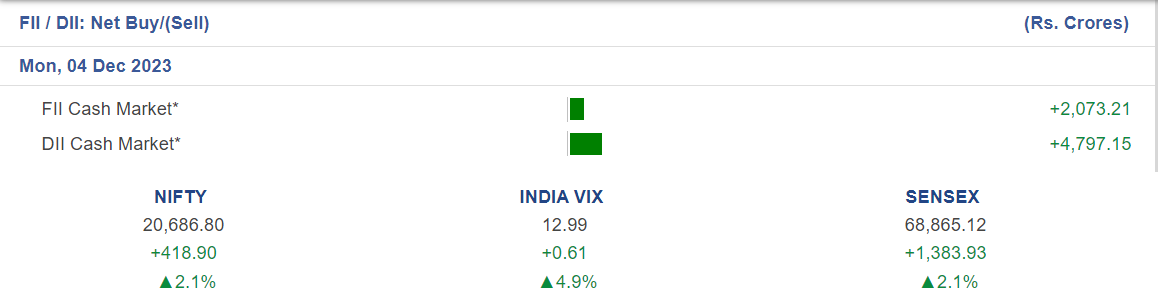

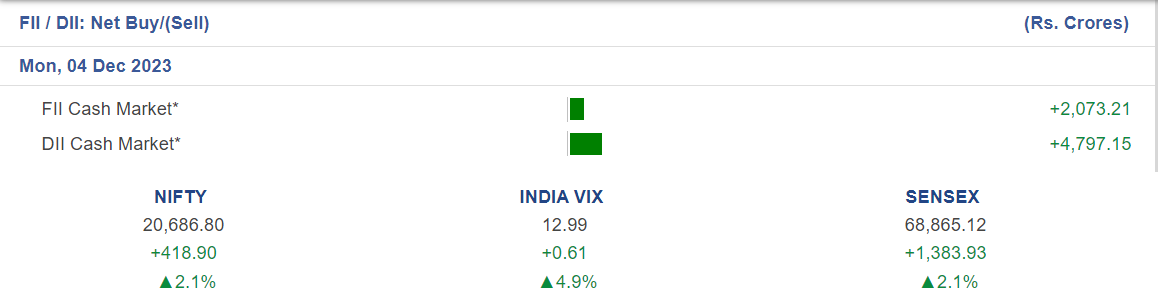

- Nifty: Gapped up over 350 points and continued to climb throughout the day, closing just below 20,700.

- Midcap and Smallcap: Rallied strongly but slightly underperformed Nifty.

- Sectoral Indices: All sectors except Nifty Pharma and Nifty Media closed higher. Nifty PSU Bank and Nifty Bank were the top gainers.

Overall Market

- Status: Confirmed Uptrend

- International Markets: 16 of the 25 developed markets are in a Confirmed Uptrend.

- Today: Nifty had a follow-through day, gaining over 1.5% on higher volume than Friday.

Outlook

- Favorable economic factors suggest a sustainable rally.

- Stocks breaking out show solid potential.

- We will monitor conditions without making any predictions.

- We will begin calculating the distribution day count and look for weaknesses in the market, if any.

……………………………………………………………………….

SENSEX Prediction

Current Trend: Positive

Long Positions: Continue to hold with daily closing stop-loss of 68,011.

Short Positions: Fresh short positions can be initiated if Sensex closes below 68,011 levels.

Support Levels: 68,454 – 68,042 – 67,810

Resistance Levels: 69,097 – 69,330 – 69,741

In simpler terms:

- The Sensex is currently in an upward trend.

- If you are holding long positions, continue to hold them, but place a stop-loss order at 68,011 to limit your losses.

- If you are not currently holding any long positions, you can initiate fresh long positions if the Sensex closes above 68,011.

- The Sensex has three support levels and three resistance levels.

- Support levels are prices at which the Sensex is expected to find support and bounce back. Resistance levels are prices at which the Sensex is expected to face resistance and sell-off.

- The support levels for the Sensex are 68,454, 68,042, and 67,810. The resistance levels for the Sensex are 69,097, 69,330, and 69,741.

Additional Analysis:

The Sensex is currently trading above all of its support levels, which is a bullish sign. The Sensex is also approaching its resistance level at 69,097. If the Sensex can break through this resistance level, it could continue to move higher in the short term. However, if the Sensex fails to break through the 69,097 resistance level, it could start to pull back in the short term.

Traders should monitor the Sensex closely in the coming days to see if it can break through the 69,097 resistance level. If it does, traders could look to buy the Sensex for a potential move higher. If the Sensex fails to break through the 69,097 resistance level, traders could look to sell the Sensex for a potential pullback.

Overall, the Sensex is in a positive trend and could continue to move higher in the short term, but it is important to watch for signs of a reversal.

NIFTY Prediction

Current Trend: Positive

Long Positions: Continue to hold with daily closing stop-loss of 20,430.

Short Positions: Fresh short positions can be initiated if Nifty closes below 20,430 levels.

Support Levels: 20,562 – 20,438 – 20,367

Resistance Levels: 20,757 – 20,827 – 20,952

In simpler terms:

- The NIFTY is currently in an upward trend.

- If you are holding long positions, continue to hold them, but place a stop-loss order at 20,430 to limit your losses.

- If you are not currently holding any long positions, you can initiate fresh long positions if the NIFTY closes above 20,430.

- The NIFTY has three support levels and three resistance levels.

- Support levels are prices at which the NIFTY is expected to find support and bounce back. Resistance levels are prices at which the NIFTY is expected to face resistance and sell-off.

- The support levels for the NIFTY are 20,562, 20,438, and 20,367. The resistance levels for the NIFTY are 20,757, 20,827, and 20,952.

Additional Analysis:

The NIFTY is currently trading above all of its support levels, which is a bullish sign. The NIFTY is also approaching its resistance level at 20,757. If the NIFTY can break through this resistance level, it could continue to move higher in the short term. However, if the NIFTY fails to break through the 20,757 resistance level, it could start to pull back in the short term.

Traders should monitor the NIFTY closely in the coming days to see if it can break through the 20,757 resistance level. If it does, traders could look to buy the NIFTY for a potential move higher. If the NIFTY fails to break through the 20,757 resistance level, traders could look to sell the NIFTY for a potential pullback.

Overall, the NIFTY is in a positive trend and could continue to move higher in the short term, but it is important to watch for signs of a reversal.

BANKNIFTY Prediction

Current Trend: Positive

Long Positions: Continue to hold with daily closing stop-loss of 45,431.

Short Positions: Fresh short positions can be initiated if Banknifty closes below 45,431 levels.

Support Levels: 45,782 – 45,133 – 44,782

Resistance Levels: 46,783 – 47,134 – 47,783

In simpler terms:

- The Banknifty is currently in an upward trend.

- If you are holding long positions, continue to hold them, but place a stop-loss order at 45,431 to limit your losses.

- If you are not currently holding any long positions, you can initiate fresh long positions if the Banknifty closes above 45,431.

- The Banknifty has three support levels and three resistance levels.

- Support levels are prices at which the Banknifty is expected to find support and bounce back. Resistance levels are prices at which the Banknifty is expected to face resistance and sell-off.

- The support levels for the Banknifty are 45,782, 45,133, and 44,782. The resistance levels for the Banknifty are 46,783, 47,134, and 47,783.

Additional Analysis:

The Banknifty is currently trading above all of its support levels, which is a bullish sign. The Banknifty is also approaching its resistance level at 46,783. If the Banknifty can break through this resistance level, it could continue to move higher in the short term. However, if the Banknifty fails to break through the 46,783 resistance level, it could start to pull back in the short term.

Traders should monitor the Banknifty closely in the coming days to see if it can break through the 46,783 resistance level. If it does, traders could look to buy the Banknifty for a potential move higher. If the Banknifty fails to break through the 46,783 resistance level, traders could look to sell the Banknifty for a potential pullback.

Overall, the Banknifty is in a positive trend and could continue to move higher in the short term, but it is important to watch for signs of a reversal.

FINNIFTY Prediction

Current Trend: Positive

Long Positions: Continue to hold with daily closing stop-loss of 20,458.

Short Positions: Fresh short positions can be initiated if Finnifty closes below 20,458 levels.

Support Levels: 20,609 – 20,356 – 20,218

Resistance Levels: 21,000 – 21,138 – 21,392

In simpler terms:

- The FINNIFTY is currently in an upward trend.

- If you are holding long positions, continue to hold them, but place a stop-loss order at 20,458 to limit your losses.

- If you are not currently holding any long positions, you can initiate fresh long positions if the FINNIFTY closes above 20,458.

- The FINNIFTY has three support levels and three resistance levels.

- Support levels are prices at which the FINNIFTY is expected to find support and bounce back. Resistance levels are prices at which the FINNIFTY is expected to face resistance and sell-off.

- The support levels for the FINNIFTY are 20,609, 20,356, and 20,218. The resistance levels for the FINNIFTY are 21,000, 21,138, and 21,392.

Additional Analysis:

The FINNIFTY is currently trading above all of its support levels, which is a bullish sign. The FINNIFTY is also approaching its resistance level at 21,000. If the FINNIFTY can break through this resistance level, it could continue to move higher in the short term. However, if the FINNIFTY fails to break through the 21,000 resistance level, it could start to pull back in the short term.

Traders should monitor the FINNIFTY closely in the coming days to see if it can break through the 21,000 resistance level. If it does, traders could look to buy the FINNIFTY for a potential move higher. If the FINNIFTY fails to break through the 21,000 resistance level, traders could look to sell the FINNIFTY for a potential pullback.

Overall, the FINNIFTY is in a positive trend and could continue to move higher in the short term, but it is important to watch for signs of a reversal.

IN HINDI —

बाजार अपडेट

- निफ्टी 350 अंक से ज्यादा बढ़कर 20,700 के करीब बंद हुआ।

- मिडकैप और स्मॉलकैप में जोरदार तेजी आई, लेकिन निफ्टी से थोड़ा कमजोर रहे।

- सभी सेक्टोरल इंडेक्स निफ्टी फार्मा और निफ्टी मीडिया को छोड़कर हरे निशान पर बंद हुए। निफ्टी पीएसयू बैंक और निफ्टी बैंक सबसे ज्यादा बढ़ने वाले थे।

अंतर्राष्ट्रीय बाजार

- 25 विकसित बाजारों में से 16 एक पुष्टि किए गए अपट्रेंड में हैं।

- निफ्टी में आज फॉलो-थ्रू डे रहा, जिसमें शुक्रवार की तुलना में ज्यादा वॉल्यूम पर डेढ़ फीसदी से ज्यादा की बढ़ोतरी हुई।

आउटलुक

- अनुकूल आर्थिक कारकों से संकेत मिलता है कि रैली टिकाऊ रहेगी।

- ब्रेकआउट करने वाले शेयरों में ठोस संभावनाएं दिख रही हैं।

- हम बिना किसी भविष्यवाणी के स्थितियों की निगरानी करेंगे।

- हम वितरण दिनों की गणना करना शुरू करेंगे और बाजार में कमजोरियों की तलाश करेंगे, यदि कोई हो।

सेंसेक्स भविष्यवाणी

- वर्तमान ट्रेंड: पॉजिटिव

- लॉन्ग पोजीशन: 68,011 के डेली क्लोजिंग स्टॉप-लॉस के साथ होल्ड करना जारी रखें।

- शॉर्ट पोजीशन: अगर सेंसेक्स 68,011 के नीचे बंद होता है तो फ्रेश शॉर्ट पोजीशन शुरू की जा सकती हैं।

निफ्टी भविष्यवाणी

- वर्तमान ट्रेंड: पॉजिटिव

- लॉन्ग पोजीशन: 20,430 के डेली क्लोजिंग स्टॉप-लॉस के साथ होल्ड करना जारी रखें।

- शॉर्ट पोजीशन: अगर निफ्टी 20,430 के नीचे बंद होता है तो फ्रेश शॉर्ट पोजीशन शुरू की जा सकती हैं।

बैंक निफ्टी भविष्यवाणी

- वर्तमान ट्रेंड: पॉजिटिव

- लॉन्ग पोजीशन: 45,431 के डेली क्लोजिंग स्टॉप-लॉस के साथ होल्ड करना जारी रखें।

- शॉर्ट पोजीशन: अगर बैंक निफ्टी 45,431 के नीचे बंद होता है तो फ्रेश शॉर्ट पोजीशन शुरू की जा सकती हैं।

फिन निफ्टी भविष्यवाणी

- वर्तमान ट्रेंड: पॉजिटिव

- लॉन्ग पोजीशन: 20,458 के डेली क्लोजिंग स्टॉप-लॉस के साथ होल्ड करना जारी रखें।

- शॉर्ट पोजीशन: अगर फिन निफ्टी 20,458 के नीचे बंद होता है तो फ्रेश शॉर्ट पोजीशन शुरू की जा सकती हैं।

Join our Telegram Channel

📲 Click on the link below to join:

🚀 Stay updated with the latest market trends and insights. 📈📊

Stay tuned for more updates – MARKETSVEIN

Nifty & Bank-Nifty Prediction for Tomorrow,Nifty & Bank-Nifty Prediction for Tomorrow,Nifty & Bank-Nifty Prediction for Tomorrow,Nifty & Bank-Nifty Prediction for Tomorrow,Nifty & Bank-Nifty Prediction for TomorrowNifty & Bank-Nifty Prediction,Nifty & Bank-Nifty Prediction for TomorrowNifty & Bank-Nifty Prediction for TomorrowNifty & Bank-Nifty Prediction for TomorrowNifty & Bank-NiftyNifty & Bank-Nifty Prediction for TomorrowNifty & Bank-Nifty Prediction for TomorrowNifty & Bank-Nifty Prediction for Tomorrow Prediction for TomorrowNifty & Bank-Nifty Prediction for Tomorrow Nifty & Bank-Nifty Prediction for TomorrowNifty & Bank-Nifty Prediction for Tomorrow Nifty & Bank-Nifty Prediction for TomorrowNifty & Bank-Nifty Prediction for Tomorrow,Nifty & Bank-Nifty Prediction for Tomorrow for Tomorrow