Nifty & Bank-Nifty Prediction for Tomorrow

SENSEX Prediction

Current Trend: Positive

Long Positions: Hold with daily closing stop-loss of 65,936

Short Positions: Initiate fresh short positions if Sensex closes below 65,936

Support Levels: 65,959, 65,636, 65,376

Resistance Levels: 66,543, 66,803, 67,126

In simpler terms:

The SENSEX is currently in a positive trend, meaning that it is expected to rise in the short term. If you are holding long positions, you should continue to hold them, but you should set a daily closing stoploss of 65,936. This means that you will sell your shares if the SENSEX closes below 65,936 on any given day.

If you are not currently holding any long positions, you can initiate fresh short positions if the SENSEX closes below 65,936. This means that you will sell shares that you do not own and buy them back later at a lower price.

The SENSEX has three support levels and three resistance levels. Support levels are prices at which the SENSEX is expected to find support and bounce back. Resistance levels are prices at which the SENSEX is expected to face resistance and sell-off.

The support levels for the SENSEX are 65,959, 65,636, and 65,376. The resistance levels for the SENSEX are 66,543, 66,803, and 67,126.

Please note: This is just a prediction and the SENSEX could move in any direction at any time. It is important to do your own research and make your own investment decisions.

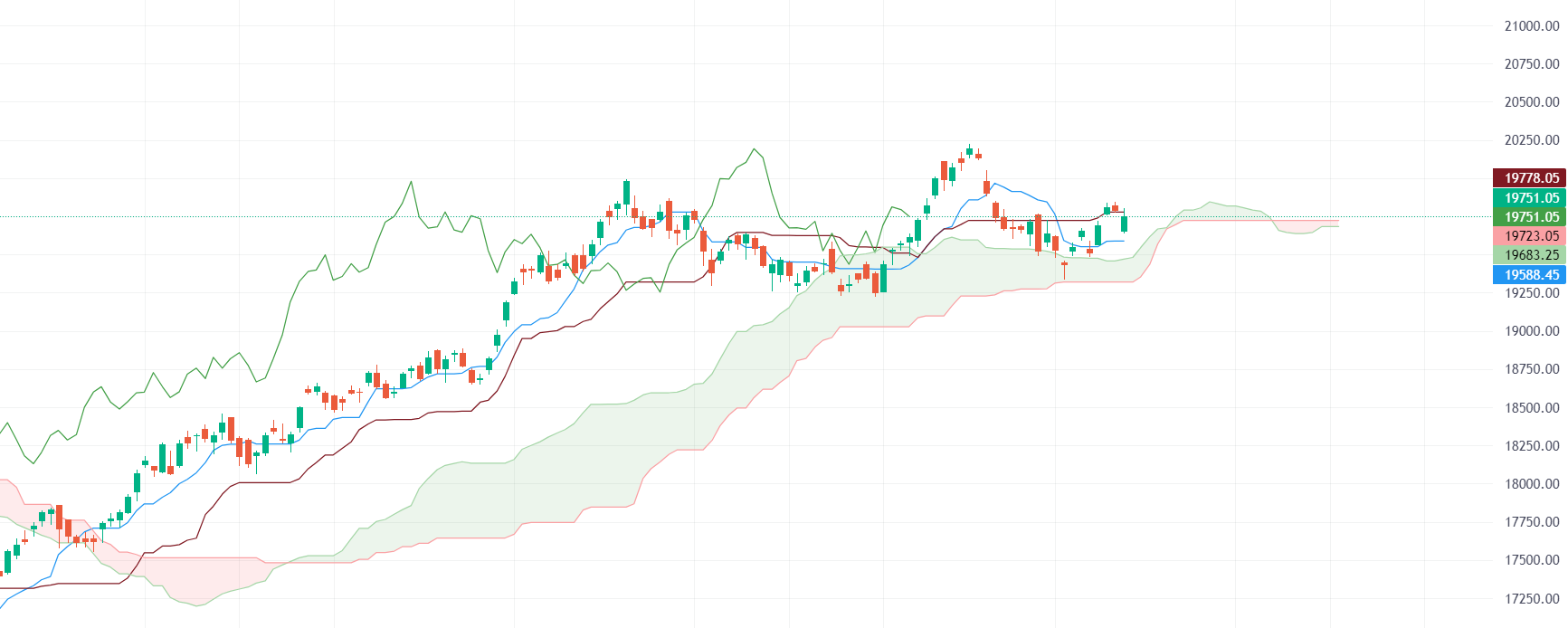

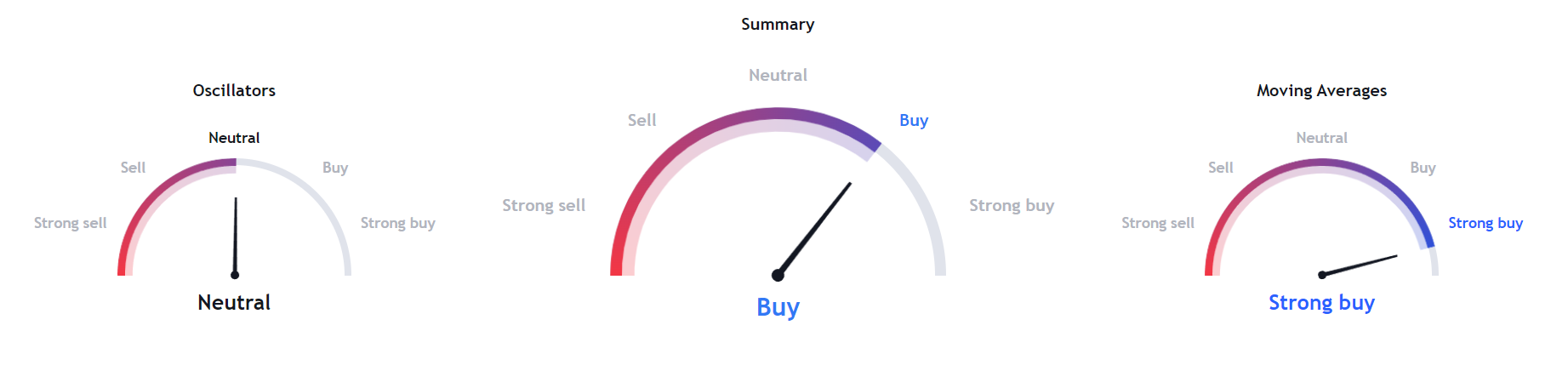

NIFTY Prediction

Current Trend: Positive

Long Positions: Hold with daily closing stop-loss of 19,654

Short Positions: Initiate fresh short positions if Nifty closes below 19,654 levels

Support Levels: 19,656, 19,560, 19,486

Resistance Levels: 19,826, 19,901, 19,996

In simpler terms:

The NIFTY is currently in a positive trend, meaning that it is expected to rise in the short term. If you are holding long positions, you should continue to hold them, but you should set a daily closing stop loss of 19,654. This means that you will sell your shares if the NIFTY closes below 19,654 on any given day.

If you are not currently holding any long positions, you can initiate fresh short positions if the NIFTY closes below 19,654. This means that you will sell shares that you do not own and buy them back later at a lower price.

The NIFTY has three support levels and three resistance levels. Support levels are prices at which the NIFTY is expected to find support and bounce back. Resistance levels are prices at which the NIFTY is expected to face resistance and sell-off.

The support levels for the NIFTY are 19,656, 19,560, and 19,486. The resistance levels for the NIFTY are 19,826, 19,901, and 19,996.

BANKNIFTY Prediction

Current Trend: Positive

Long Positions: Hold with daily closing stop-loss of 44,181

Short Positions: Initiate fresh short positions if Banknifty closes below 44,181 levels

Support Levels: 44,140, 43,992, 43,781

Resistance Levels: 44,499, 44,711, 44,859

In simpler terms:

The BANKNIFTY is currently in a positive trend, meaning that it is expected to rise in the short term. If you are holding long positions, you should continue to hold them, but you should set a daily closing stop-loss of 44,181. This means that you will sell your shares if the BANKNIFTY closes below 44,181 on any given day.

If you are not currently holding any long positions, you can initiate fresh short positions if the BANKNIFTY closes below 44,181. This means that you will sell shares that you do not own and buy them back later at a lower price.

The BANKNIFTY has three support levels and three resistance levels. Support levels are prices at which the BANKNIFTY is expected to find support and bounce back. Resistance levels are prices at which the BANKNIFTY is expected to face resistance and sell-off.

The support levels for the BANKNIFTY are 44,140, 43,992, and 43,781. The resistance levels for the BANKNIFTY are 44,499, 44,711, and 44,859.

Please note: This is just a prediction and the BANKNIFTY could move in any direction at any time. It is important to do your own research and make your own investment decisions.

Additional notes:

- The BANKNIFTY is an index of the most liquid and actively traded banking stocks in India. It is a good indicator of the overall performance of the Indian banking sector.

- The BANKNIFTY is currently in a positive trend, but it is important to note that the stock market can be volatile. It is always important to have a stop-loss in place to limit your losses.

- If you are considering shorting the BANKNIFTY, it is important to do your research and understand the risks involved. Shorting is a risky strategy and can lead to significant losses if the market moves against you.

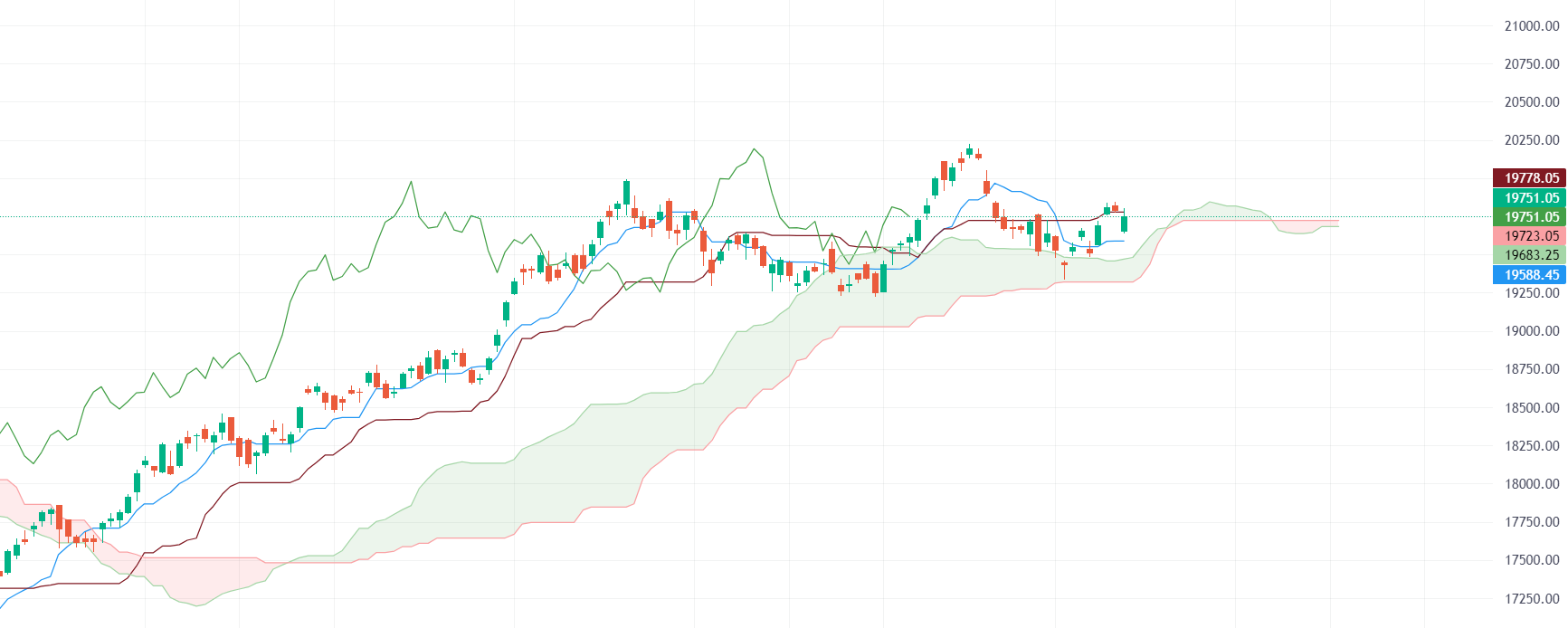

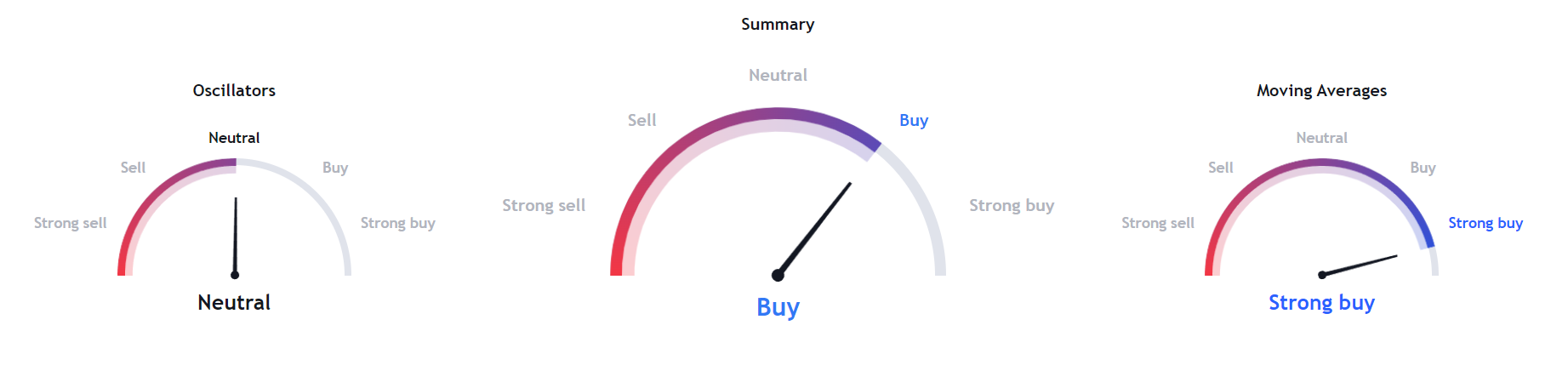

FINNIFTY Prediction

Current Trend: Positive

Long Positions: Hold with daily closing stop-loss of 19,753

Short Positions: Initiate fresh short positions if Finnifty closes below 19,753 levels

Support Levels: 19,765, 19,702, 19,616

Resistance Levels: 19,914, 20,000, 20,063

In simpler terms:

The FINNIFTY is currently in a positive trend, meaning that it is expected to rise in the short term. If you are holding long positions, you should continue to hold them, but you should set a daily closing stoploss of 19,753. This means that you will sell your shares if the FINNIFTY closes below 19,753 on any given day.

If you are not currently holding any long positions, you can initiate fresh short positions if the FINNIFTY closes below 19,753. This means that you will sell shares that you do not own and buy them back later at a lower price.

The FINNIFTY has three support levels and three resistance levels. Support levels are prices at which the FINNIFTY is expected to find support and bounce back. Resistance levels are prices at which the FINNIFTY is expected to face resistance and sell-off.

The support levels for the FINNIFTY are 19,765, 19,702, and 19,616. The resistance levels for the FINNIFTY are 19,914, 20,000, and 20,063.

Please note: This is just a prediction and the FINNIFTY could move in any direction at any time. It is important to do your own research and make your own investment decisions.

Additional notes:

- The FINNIFTY is an index of the most liquid and actively traded financial services stocks in India. It is a good indicator of the overall performance of the Indian financial services sector.

- The FINNIFTY is currently in a positive trend, but it is important to note that the stock market can be volatile. It is always important to have a stop-loss in place to limit your losses.

- If you are considering shorting the FINNIFTY, it is important to do your research and understand the risks involved. Shorting is a risky strategy and can lead to significant losses if the market moves against you.

TODAYS MARKETS INSIGHT

Nifty had a weak start to the week, dipping below 19,500 on Monday. Trading volume was low. The index reversed on Tuesday, regaining its 50-DMA. The positive momentum continued, and the index reclaimed its 21-DMA. Yesterday’s trading session was quiet. Today, Nifty gapped down but found support near the 50-DMA and rebounded significantly. However, we considered today’s action a distribution day, as the decline was more than 0.2% and the trading volume was higher than the previous session.

In hindi –

निफ्टी, बैंक निफ्टी और फिन निफ्टी के लिए कल की भविष्यवाणी

सेंसेक्स भविष्यवाणी

वर्तमान प्रवृत्ति: सकारात्मक

लॉन्ग पोजीशन: 65,936 के दैनिक क्लोजिंग स्टॉप-लॉस के साथ होल्ड करें

शॉर्ट पोजीशन: सेंसेक्स 65,936 के नीचे बंद होने पर नए शॉर्ट पोजीशन शुरू करें

सपोर्ट लेवल: 65,959, 65,636, 65,376

रेजिस्टेंस लेवल: 66,543, 66,803, 67,126

निफ्टी भविष्यवाणी

वर्तमान प्रवृत्ति: सकारात्मक

लॉन्ग पोजीशन: 19,654 के दैनिक क्लोजिंग स्टॉप-लॉस के साथ होल्ड करें

शॉर्ट पोजीशन: निफ्टी 19,654 के नीचे बंद होने पर नए शॉर्ट पोजीशन शुरू करें

सपोर्ट लेवल: 19,656, 19,560, 19,486

रेजिस्टेंस लेवल: 19,826, 19,901, 19,996

बैंक निफ्टी भविष्यवाणी

वर्तमान प्रवृत्ति: सकारात्मक

लॉन्ग पोजीशन: 44,181 के दैनिक क्लोजिंग स्टॉप-लॉस के साथ होल्ड करें

शॉर्ट पोजीशन: बैंक निफ्टी 44,181 के नीचे बंद होने पर नए शॉर्ट पोजीशन शुरू करें

सपोर्ट लेवल: 44,140, 43,992, 43,781

रेजिस्टेंस लेवल: 44,499, 44,711, 44,859

फिन निफ्टी भविष्यवाणी

वर्तमान प्रवृत्ति: सकारात्मक

लॉन्ग पोजीशन: 19,753 के दैनिक क्लोजिंग स्टॉप-लॉस के साथ होल्ड करें

शॉर्ट पोजीशन: फिन निफ्टी 19,753 के नीचे बंद होने पर नए शॉर्ट पोजीशन शुरू करें

सपोर्ट लेवल: 19,765, 19,702, 19,616

रेजिस्टेंस लेवल: 19,914, 20,000, 20,063

आज के बाजार की अंतर्दृष्टि

निफ्टी ने इस सप्ताह की शुरुआत कमजोर की, सोमवार को 19,500 से नीचे गिर गया। ट्रेडिंग वॉल्यूम कम था। सूचकांक मंगलवार को उलट गया, अपना 50-डीएमए हासिल कर लिया। सकारात्मक गति जारी रही, और सूचकांक ने अपना 21-डीएमए हासिल कर लिया। कल का ट्रेडिंग सत्र शांत रहा। आज, निफ्टी ने गैप डाउन किया लेकिन 50-डीएमए के पास समर्थन पाया और काफी हद तक रिबाउंड हुआ। हालांकि, हमने आज की कार्रवाई को एक डिस्ट्रीब्यूशन डे माना है, क्योंकि गिरावट 0.2% से अधिक थी और ट्रेडिंग वॉल्यूम पिछले सत्र से अधिक था।

कुल मिलाकर, बाजार सकारात्मक प्रवृत्ति में हैं, लेकिन सावधान रहना जरूरी है क्योंकि बाजार वितरण के संकेत दिखा रहा है। नुकसान को सीमित करने के लिए स्टॉप-लॉस के साथ व्यापार करना हमेशा उचित होता है।

Join our Telegram Channel

📲 Click on the link below to join:

🚀 Stay updated with the latest market trends and insights. 📈📊

Stay tuned for more updates – MARKETSVEIN