Nifty & Bank-Nifty Prediction for Tomorrow, Oct 27 2023

Sensex Prediction for October 27, 2023

Current Trend: Negative

Short Positions: Continue to hold with daily closing stop-loss of 64,053.

Long Positions: Fresh long positions can be initiated if Sensex closes above 64,053 levels.

Support Levels: 62,903 – 62,657 – 62,222

Resistance Levels: 63,584 – 64,020 – 64,265

In simpler terms:

- The Sensex is currently in a negative trend, meaning that it is expected to fall in the short term.

- If you are holding short positions on the Sensex, you should continue to hold them, but you should set a daily closing stop-loss of 64,053. This means that you will sell your shares if the Sensex closes below 64,053 on any given day.

- If you are not currently holding any short positions on the Sensex, you can initiate fresh short positions if the Sensex closes below 64,053 levels. This means that you will sell shares that you do not own and buy them back later at a lower price.

- The Sensex has three support levels and three resistance levels. Support levels are prices at which the Sensex is expected to find support and bounce back. Resistance levels are prices at which the Sensex is expected to face resistance and sell-off.

- The support levels for the Sensex are 62,903, 62,657, and 62,222. The resistance levels for the Sensex are 63,584, 64,020, and 64,265.

Please note: This is just a prediction and the Sensex could move in any direction at any time. It is important to do your own research and make your own investment decisions.

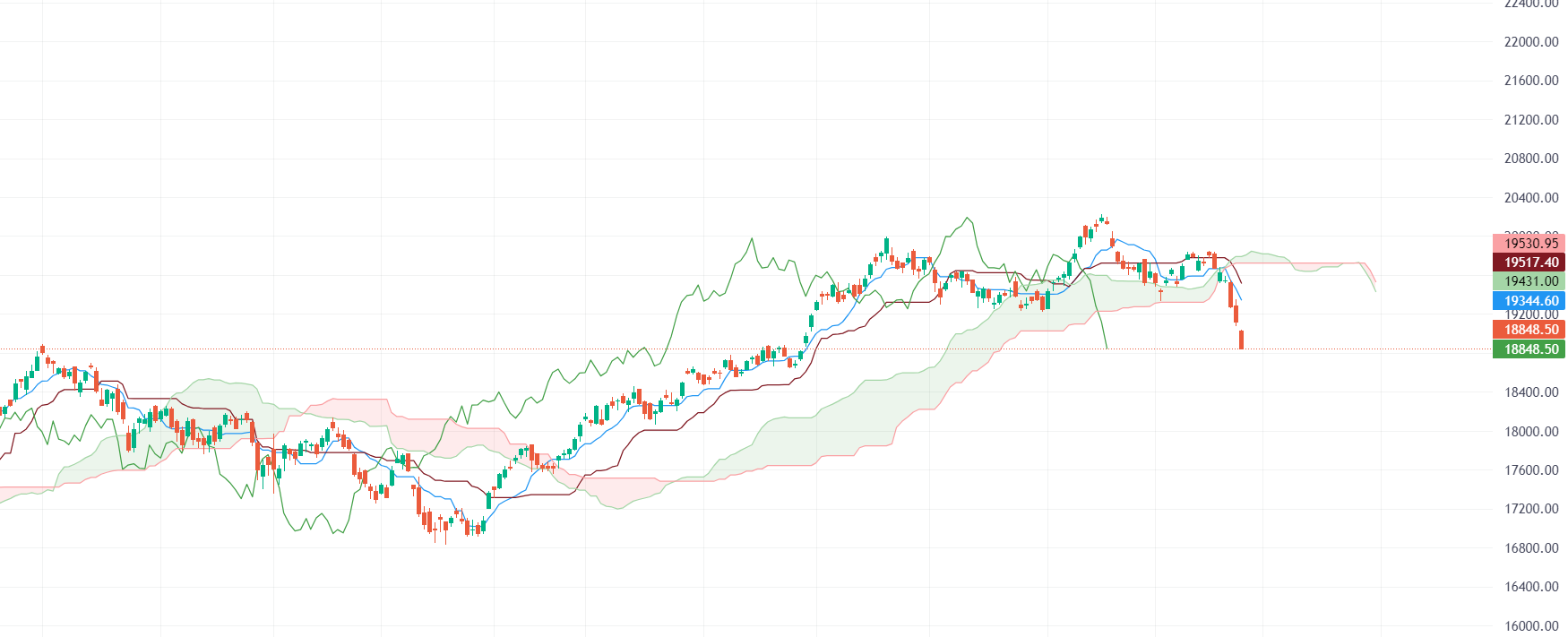

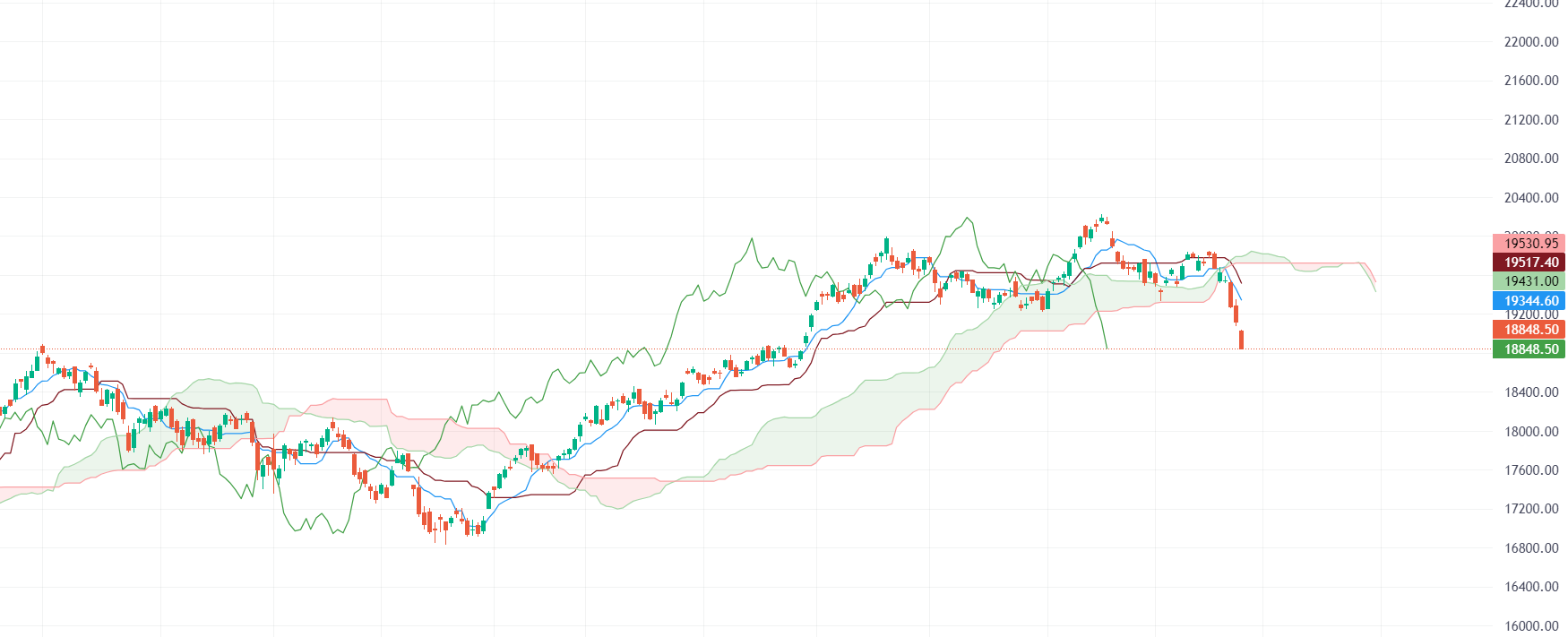

Nifty Prediction for October 27, 2023

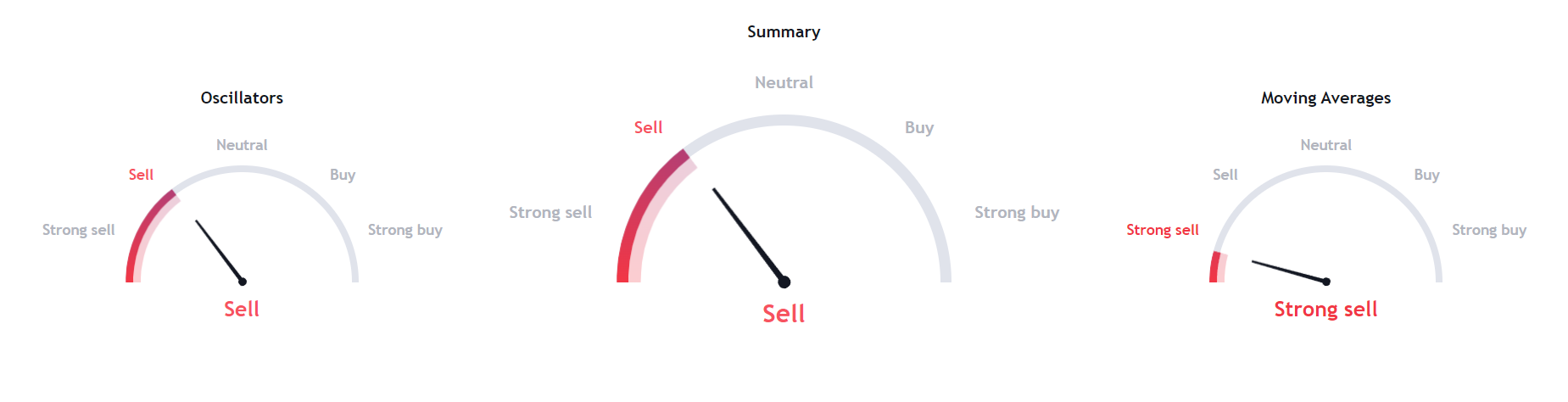

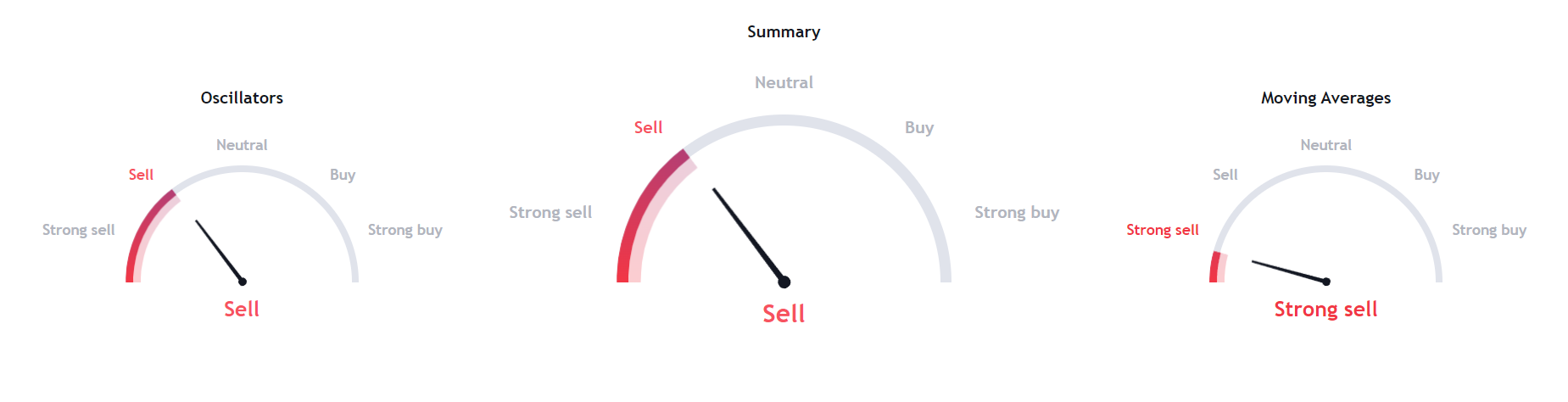

Current Trend: Negative

Short Positions: Continue to hold with daily closing stop-loss of 19,127.

Long Positions: Fresh long positions can be initiated if Nifty closes above 19,127 levels.

Support Levels: 18,783 – 18,708 – 18,579

Resistance Levels: 18,987 – 19,116 – 19,191

In simpler terms:

- The Nifty is currently in a negative trend, meaning that it is expected to fall in the short term.

- If you are holding short positions on the Nifty, you should continue to hold them, but you should set a daily closing stop-loss of 19,127. This means that you will sell your shares if the Nifty closes below 19,127 on any given day.

- If you are not currently holding any short positions on the Nifty, you can initiate fresh short positions if the Nifty closes below 19,127 levels. This means that you will sell shares that you do not own and buy them back later at a lower price.

- The Nifty has three support levels and three resistance levels. Support levels are prices at which the Nifty is expected to find support and bounce back. Resistance levels are prices at which the Nifty is expected to face resistance and sell-off.

- The support levels for the Nifty are 18,783, 18,708, and 18,579. The resistance levels for the Nifty are 18,987, 19,116, and 19,191.

Please note: This is just a prediction and the Nifty could move in any direction at any time. It is important to do your own research and make your own investment decisions.

Bank Nifty Prediction for October 27, 2023

Current Trend: Negative

Short Positions: Continue to hold with daily closing stop-loss of 42,919.

Long Positions: Fresh long positions can be initiated if Bank Nifty closes above 42,919 levels.

Support Levels: 42,018 – 41,756 – 41,408

Resistance Levels: 42,629 – 42,978 – 43,240

In simpler terms:

- The Bank Nifty is currently in a negative trend, meaning that it is expected to fall in the short term.

- If you are holding short positions on the Bank Nifty, you should continue to hold them, but you should set a daily closing stop-loss of 42,919. This means that you will sell your shares if the Bank Nifty closes below 42,919 on any given day.

- If you are not currently holding any short positions on the Bank Nifty, you can initiate fresh short positions if the Bank Nifty closes below 42,919 levels. This means that you will sell shares that you do not own and buy them back later at a lower price.

- The Bank Nifty has three support levels and three resistance levels. Support levels are prices at which the Bank Nifty is expected to find support and bounce back. Resistance levels are prices at which the Bank Nifty is expected to face resistance and sell-off.

- The support levels for the Bank Nifty are 42,018, 41,756, and 41,408. The resistance levels for the Bank Nifty are 42,629, 42,978, and 43,240.

Please note: This is just a prediction and the Bank Nifty could move in any direction at any time. It is important to do your own research and make your own investment decisions.

Finnifty Prediction for October 27, 2023

Current Trend: Negative

Short Positions: Continue to hold with daily closing stoploss of 19,244.

Long Positions: Fresh long positions can be initiated if Finnifty closes above 19,244 levels.

Support Levels: 18,808 – 18,694 – 18,517

Resistance Levels: 19,099 – 19,276 – 19,391

In simpler terms:

- The Finnifty is currently in a negative trend, meaning that it is expected to fall in the short term.

- If you are holding short positions on the Finnifty, you should continue to hold them, but you should set a daily closing stop-loss of 19,244. This means that you will sell your shares if the Finnifty closes below 19,244 on any given day.

- If you are not currently holding any short positions on the Finnifty, you can initiate fresh short positions if the Finnifty closes below 19,244 levels. This means that you will sell shares that you do not own and buy them back later at a lower price.

- The Finnifty has three support levels and three resistance levels. Support levels are prices at which the Finnifty is expected to find support and bounce back. Resistance levels are prices at which the Finnifty is expected to face resistance and sell-off.

- The support levels for the Finnifty are 18,808, 18,694, and 18,517. The resistance levels for the Finnifty are 19,099, 19,276, and 19,391.

Please note: This is just a prediction and the Finnifty could move in any direction at any time. It is important to do your own research and make your own investment decisions.

TODAYS MARKETS INSIGHT

Nifty fell continuously today, closing near the day’s low. All sectoral indices closed lower, with Nifty Auto, Metal, and Financial Service being the major decliners.

👇👇👇

Just check out analysis of upcoming IPO – LINK

Disclaimer: This article is for informational purposes only and should not be considered as financial advice. Investing in stocks, and IPOs carries inherent risks, and individuals should perform their own due diligence before making any investment decisions. Please note that I am not a SEBI registered stock analyst, and the information provided in this analysis is purely for educational purposes.

Nifty & Bank-Nifty भविष्यवाणी 27 अक्टूबर 2023

सेंसेक्स भविष्यवाणी

- वर्तमान रुझान: नकारात्मक

- शॉर्ट पोजीशन: 64,053 के दैनिक समापन स्टॉप-लॉस के साथ जारी रखें।

- लंबी स्थिति: यदि सेंसेक्स 64,053 के स्तर से ऊपर बंद हो जाता है तो नई लंबी स्थिति शुरू की जा सकती है।

- समर्थन स्तर: 62,903 – 62,657 – 62,222

- प्रतिरोध स्तर: 63,584 – 64,020 – 64,265

सरल शब्दों में:

- सेंसेक्स वर्तमान में नकारात्मक रुझान में है, जिसका अर्थ है कि यह अल्पकाल में गिरने की उम्मीद है।

- यदि आप सेंसेक्स पर शॉर्ट पोजीशन रख रहे हैं, तो उन्हें जारी रखें, लेकिन आपको 64,053 के दैनिक समापन स्टॉप-लॉस सेट करना चाहिए। इसका मतलब है कि यदि सेंसेक्स किसी भी दिन 64,053 से नीचे बंद हो जाता है तो आप अपने शेयर बेच देंगे।

- यदि आप वर्तमान में सेंसेक्स पर कोई शॉर्ट पोजीशन नहीं रख रहे हैं, तो आप 64,053 के स्तर से नीचे बंद होने पर नई शॉर्ट पोजीशन शुरू कर सकते हैं। इसका मतलब है कि आप शेयर बेचेंगे जो आपके पास नहीं हैं और बाद में एक कम कीमत पर वापस खरीदेंगे।

- सेंसेक्स में तीन समर्थन स्तर और तीन प्रतिरोध स्तर हैं। समर्थन स्तर वे स्तर हैं जिन पर सेंसेक्स को समर्थन मिलने और वापस उछाल की उम्मीद है। प्रतिरोध स्तर वे स्तर हैं जिन पर सेंसेक्स को प्रतिरोध का सामना करने और बिकवाली की उम्मीद है।

- सेंसेक्स के समर्थन स्तर 62,903, 62,657 और 62,222 हैं। सेंसेक्स के प्रतिरोध स्तर 63,584, 64,020 और 64,265 हैं।

कृपया ध्यान दें: यह केवल एक भविष्यवाणी है और सेंसेक्स किसी भी दिशा में किसी भी समय आगे बढ़ सकता है। अपनी स्वयं की शोध और निवेश निर्णय लेने के लिए महत्वपूर्ण है।

निफ्टी भविष्यवाणी

- वर्तमान रुझान: नकारात्मक

- शॉर्ट पोजीशन: 19,127 के दैनिक समापन स्टॉप-लॉस के साथ जारी रखें।

- लंबी स्थिति: यदि निफ्टी 19,127 के स्तर से ऊपर बंद हो जाता है तो नई लंबी स्थिति शुरू की जा सकती है।

- समर्थन स्तर: 18,783 – 18,708 – 18,579

- प्रतिरोध स्तर: 18,987 – 19,116 – 19,191

सरल शब्दों में:

- निफ्टी वर्तमान में नकारात्मक रुझान में है, जिसका अर्थ है कि यह अल्पकाल में गिरने की उम्मीद है।

- यदि आप निफ्टी पर शॉर्ट पोजीशन रख रहे हैं, तो उन्हें जारी रखें, लेकिन आपको 19,127 के दैनिक समापन स्टॉप-लॉस सेट करना चाहिए। इसका मतलब है कि यदि निफ्टी किसी भी दिन 19,127 से नीचे बंद हो जाता है तो आप अपने शेयर बेच देंगे।

- यदि आप वर्तमान में निफ्टी पर कोई शॉर्ट पोजीशन नहीं रख रहे हैं, तो आप 19,127 के स्तर से नीचे बंद होने पर नई शॉर्ट पोजीशन शुरू कर सकते हैं। इसका मतलब है कि आप शेयर बेचेंगे जो आपके पास नहीं हैं और बाद में एक कम कीमत पर वापस खरीदेंगे।

- निफ्टी में तीन समर्थन स्तर और तीन प्रतिरोध स्तर हैं। समर्थन स्तर वे स्तर हैं जिन पर निफ्टी को समर्थन मिलने और वापस उछाल की उम्मीद है। प्रतिरोध स्तर वे स्तर हैं जिन पर निफ्टी को प्रतिरोध का सामना करने और बिकवाली की उम्मीद है।

- निफ्टी के समर्थन स्तर 18,783

Join our Telegram Channel

📲 Click on the link below to join:

🚀 Stay updated with the latest market trends and insights. 📈📊

Stay tuned for more updates – MARKETSVEIN